US tariffs’ toll on Canadian steel exports to rise in 2026

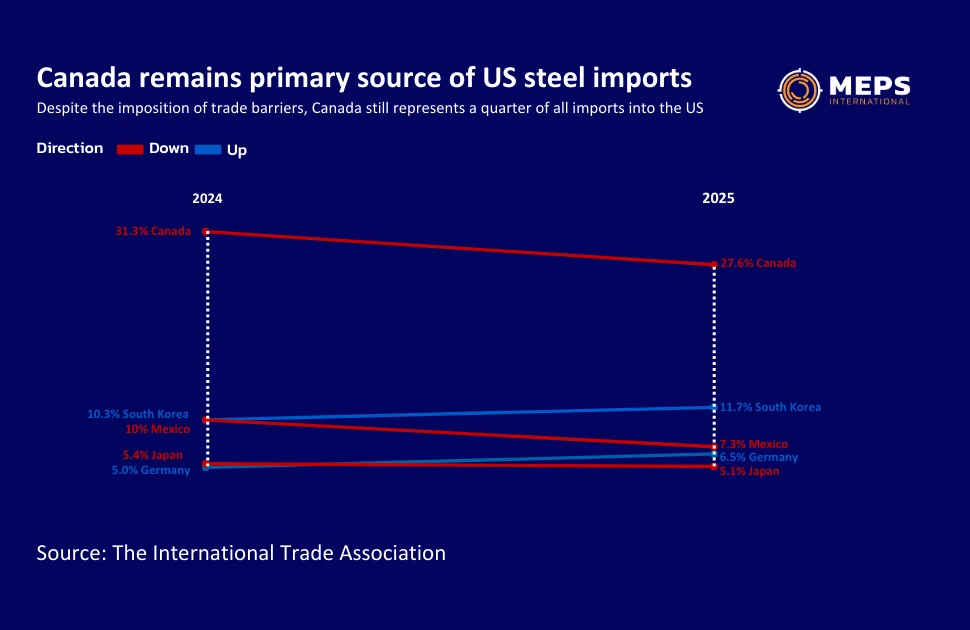

Canada maintained its position as the largest source of steel imports into the United States in 2025, despite the doubling of Section 232 steel tariffs to 50%.

Imports of Canadian-origin flat and long finished carbon steel products (excluding pipes and tubes) declined by 32% year-on-year over the 12-month period, data published by the International Trade Association indicates. This exceeded a 23% overall decline in US steel imports.

Last year, nearly 3.3 million tonnes of Canadian steel entered the US market, keeping Canada as the leading foreign supplier with 28% of total imports (see graphic in image carousel, above).

MEPS US steel market analyst Laura Hodges said: “I continue to hear that steel imports into the US have dried up, particularly from Canada. This is not the case, despite the 50% tariff. Steel imports dropped last year and will further decline in 2026. However, the US will continue to import steel as, despite recent capacity investments, certain products are not produced domestically. The US also remains an attractive market due to its size and comparatively high steel prices.”

However, US imports from Canada are expected to drop further in 2026.

In March 2025, the US reinstated Section 232 tariffs on steel to the full 25% with no quotas, exemptions or exclusions. Under the previous system, some countries were paying the full 25% tariff on steel imports while others, including Canada, were paying no tariff. In July 2025, the Section 232 steel tariff was increased to 50%. Consequently, the tariff on Canadian-origin steel products went from 0% to 50% in five months, dramatically altering the supply chain with financial implications for both buyers and sellers.

Contract sales may have mitigated tariffs’ early effects

US steel import tariffs have diminished Canada’s influence in the US steel market. The decline was more dramatic in the latter half of the year due to the increased tariff and the front loading of steel imports in the first three months of the year, prior to the initial blanket reintroduction of Section 232 tariffs. In the July-December period, US steel imports from Canada dropped by 44% year-on-year.

The mix of flat and long steel imports has also changed over the last year. Given Canada’s strong ties to the US automotive sector, the decline in flat product imports has been less than that of long products. In 2024, flat products, including galvanised and other coil products, made up 75% of Canadian-origin imports. In 2025, that share increased to 77%. However, the full toll of US tariffs on this product may not have been felt. Most automotive steel shipments are subject to long-term contract agreements, keeping flat product volumes elevated during 2025. According to MEPS respondents, fewer Canadian contracts will be renewed this year due to the cost of tariffs, reducing the flow of flat products.

Canadian steel mills have suffered financially due to US import tariffs and the resulting decline in US export opportunities. In 2024, almost 95% of Canadian exports were sent to the US.

Adapting to reduced US-Canada trade

Last year, Algoma Steel, ArcelorMittal Dofasco and Stelco reduced their respective workforces and curtailed operations to better align supply with subdued demand. MEPS research respondents in Canada said that Dofasco and Stelco are operating at around 50% of their production capacity, and Algoma is in the process of shutting down its blast furnace. As previously reported by MEPS, however, Algoma is progressing plans to open a structural beam production facility as it refocuses its attention on its domestic market.

Steel production and imports are also down in Canada. In the first 11 months of 2025, steel production was down by 4% compared with the same period in 2024, according to worldsteel. To support and protect its domestic steel industry, the Canadian government has introduced a new tariff-rate quota system, implementing a 50% above-quota tariff and tightening its tariff-rate quotas as of December 26, 2025. Canada’s steel imports declined by 22% last year. Volumes of the country’s most commonly imported steel product, coated sheet, fell by 28% according to Canada’s steel import monitoring programme.

The role of Canadian steel in the US market will continue to decline unless the Section 232 tariff is reduced or eliminated. There is currently little indication that Section 232 steel tariffs will be reduced or eliminated. However, the United States-Mexico-Canada Agreement will be reviewed in July. Steel exports will be a focus point for the Canadian administration in the upcoming negotiations.

Research conducted for MEPS’s International Steel Review revealed that, last month, Canadian steel mills raised prices sharply in an effort to restore profitability and reposition their businesses without reliance on US steel exports. In the absence of relief from the 50% steel tariff, those steelmakers will remain increasingly reliant on domestic demand.

Source:

International Steel Review

The MEPS International Steel Review is an essential monthly publication, offering professional analysis and insight into carbon steel prices around the world.

Go to productRequest a free publication