How did steel prices reach record highs during a global pandemic?

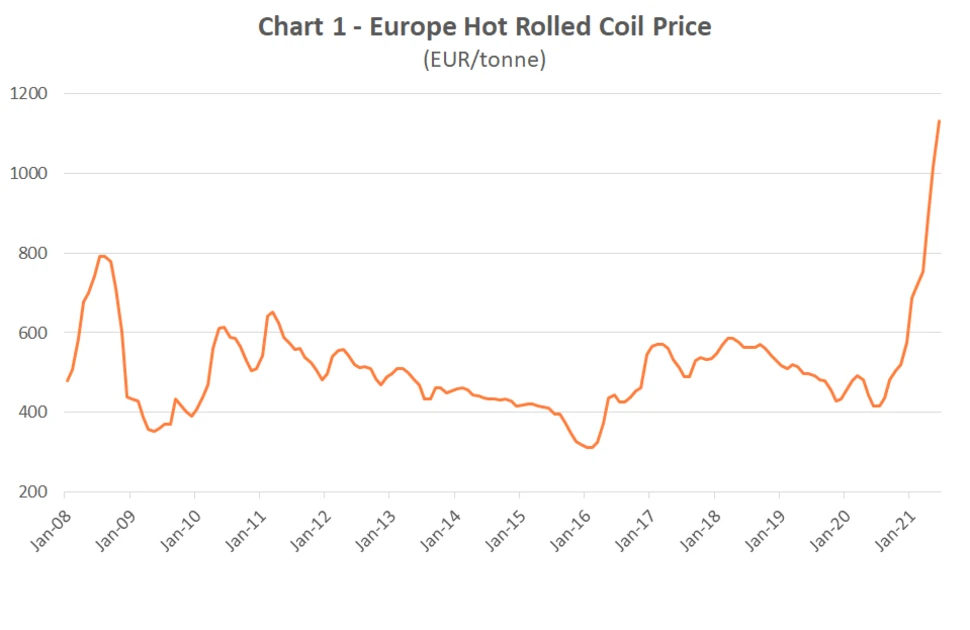

Steel prices currently stand at record highs, even dwarfing the previous peak recorded during the boom of 2008 (see Chart 1). In the past twelve months, the MEPS Europe hot rolled coil price has increased by more than €700 per tonne. How did this unprecedented situation transpire?

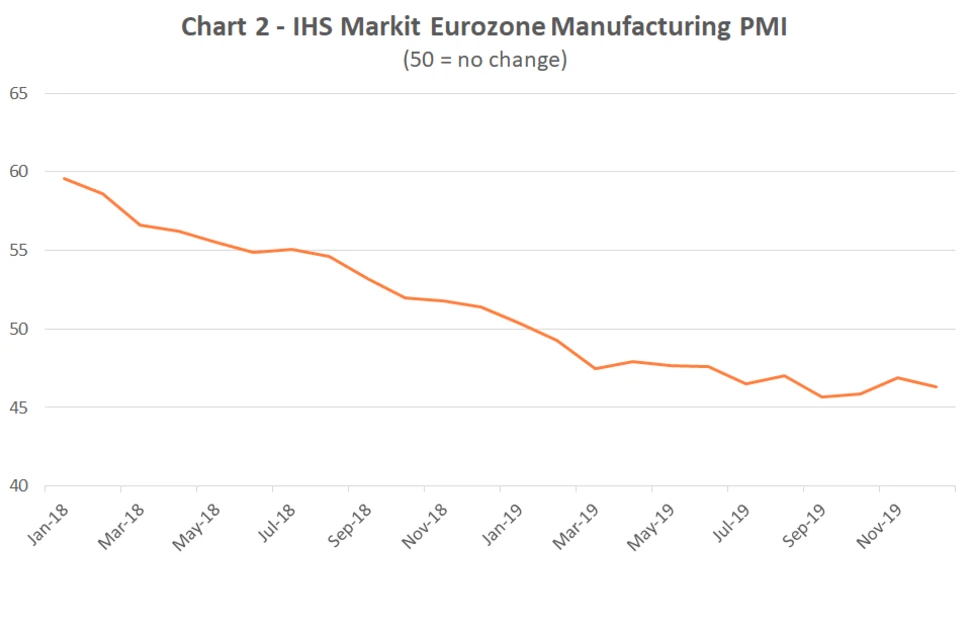

After reaching a high point in early 2018, European steel prices and economic indicators started to deteriorate (see Chart 2). The negative trend accelerated during 2019, as steel consumption weakened, particularly in the automotive sector, and oversupply pressures grew.

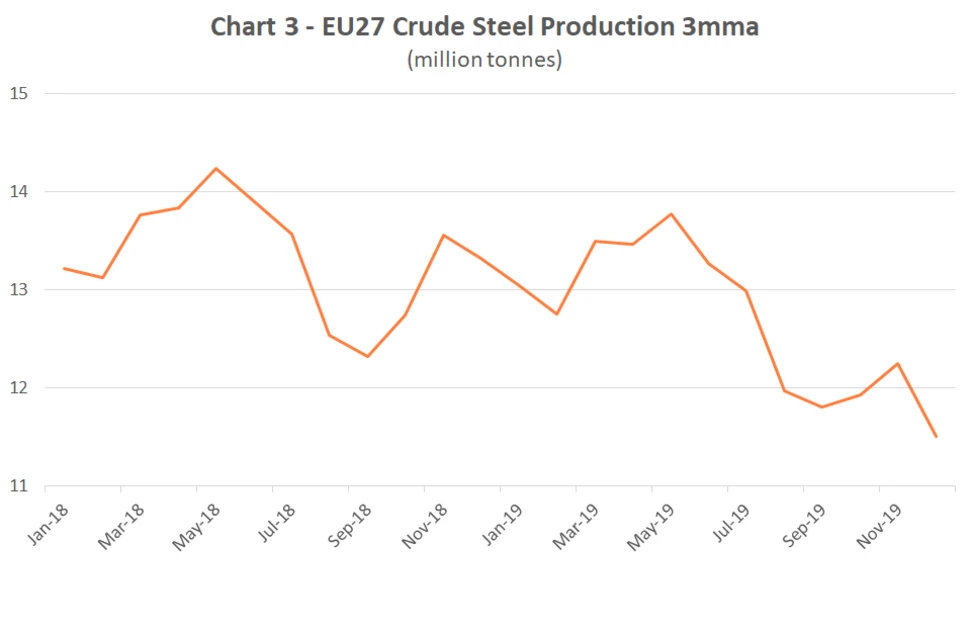

Destocking was undertaken throughout the supply chain, due to the demand uncertainty and the need for companies to generate cash. Steel mills, faced with reduced order books, were forced to lower their output (see Chart 3).

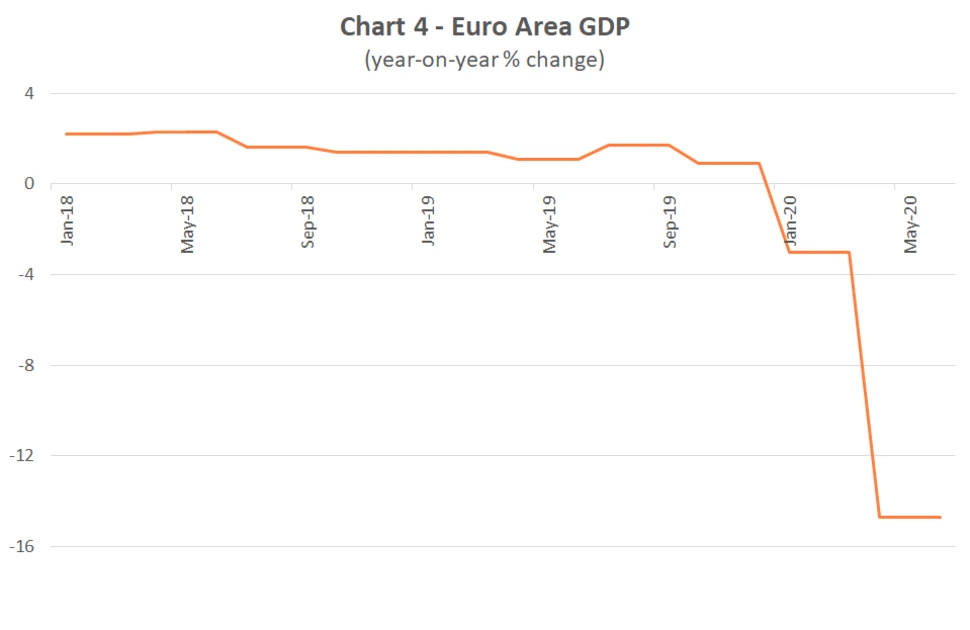

A tentative sense of optimism was noted at the start of 2020, with low inventories and earlier steel production cuts exerting upward pressure on European prices. Then the Covid-19 pandemic hit and negative sentiment took hold. Lockdowns were implemented as governments attempted to slow the spread of the virus, and economic activity plummeted (see Chart 4).

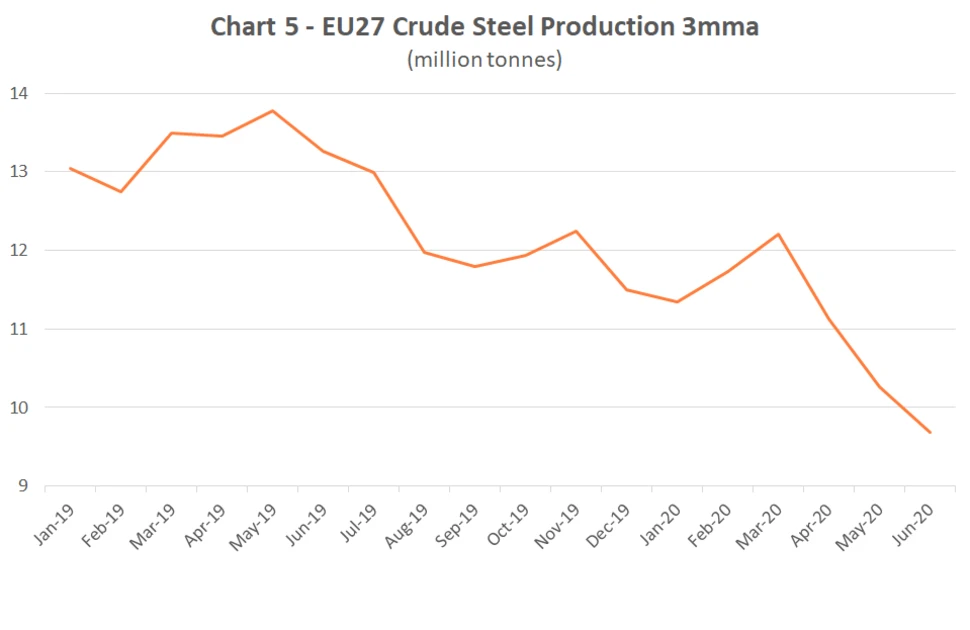

Manufacturing of steel-containing goods, particularly motor vehicles, was slashed. Supply chains were severely disrupted, with many companies being unable to obtain the components that they required. Steel inventory levels, which were already relatively low, were reduced further. European mills faced order cancellations and undertook large production cuts and plant idling (see Chart 5).

However, expectations of a protracted downturn in economic activity, steel demand and prices, failed to transpire. After the initial market shock, China started to rebound in the spring, followed by the rest of the world in the second half of the year. China’s ability to control the spread of the virus, and aggressive government fiscal and monetary policy, including infrastructure spending, helped the country’s revival.

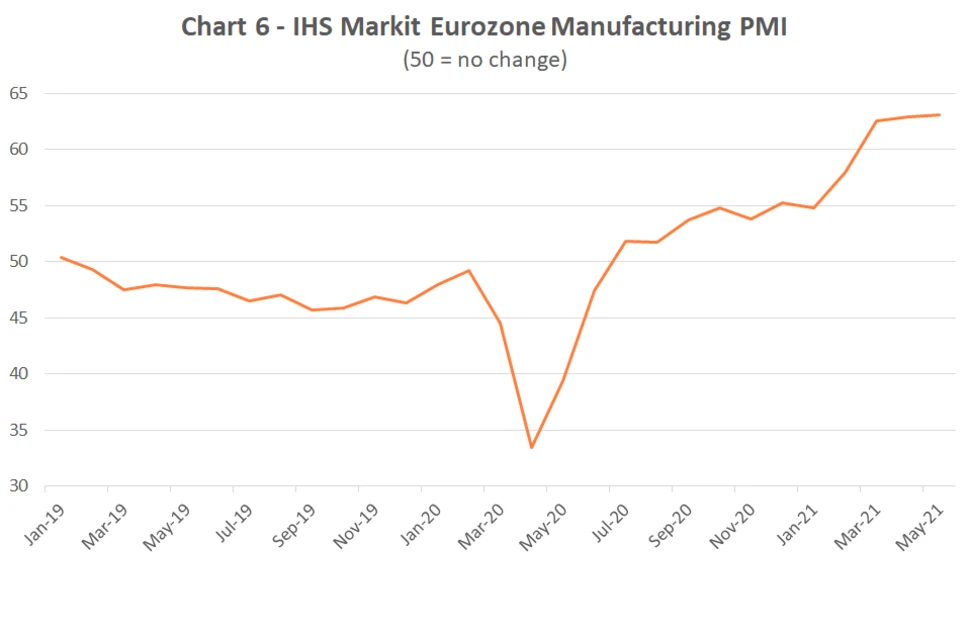

In Europe, despite rising Covid cases, the steel market started to recover. Subsequent lockdowns allowed steel-intensive end-user sectors to continue to operate, and sentiment improved (see Chart 6). The biggest impact of the lockdowns was on the less steel-intensive service sectors, such as hospitality, retail and tourism.

Production’s slow recovery

As steel demand started to return, it met vastly reduced supply. During the middle of 2020, European mills had carried out very large output cuts. A number of factors contributed to the subsequent slow ramp up of production. Steelmakers faced various technical difficulties bringing equipment back on stream, and social distancing created restrictions for workers at plants. Mills struggled to obtain the necessary raw materials, due to supply chain disruptions, with shortages of containers, soaring freight costs and delays at ports.

Moreover, steel producers could not afford to have large amounts of cash tied up in expensive inventories of raw materials. Iron ore prices had increased substantially, as a result of robust Chinese steel production and concerns about ore shipments from Brazil (see Chart 7).

European mills were reluctant to rapidly restore capacity, for fear of jeopardising the steel price recovery and potentially being left with excess supply, if demand fell away again. They did not want a repeat of 2019 or the second quarter of 2020, when large end-users failed to take their allocations and cancelled orders.

The steelmakers’ fears failed to transpire, as demand from end-users went from strength to strength. This was particularly notable in the automotive sector, where companies had depleted their inventories to very low levels. As the mills’ order intake from the vehicle manufacturers grew, less material was made available for the general market. Initially, this was only a modest problem, as many steel distributors continued to purchase cautiously and did not have the available finance to commit to substantial stock replenishment.

Steel shortages

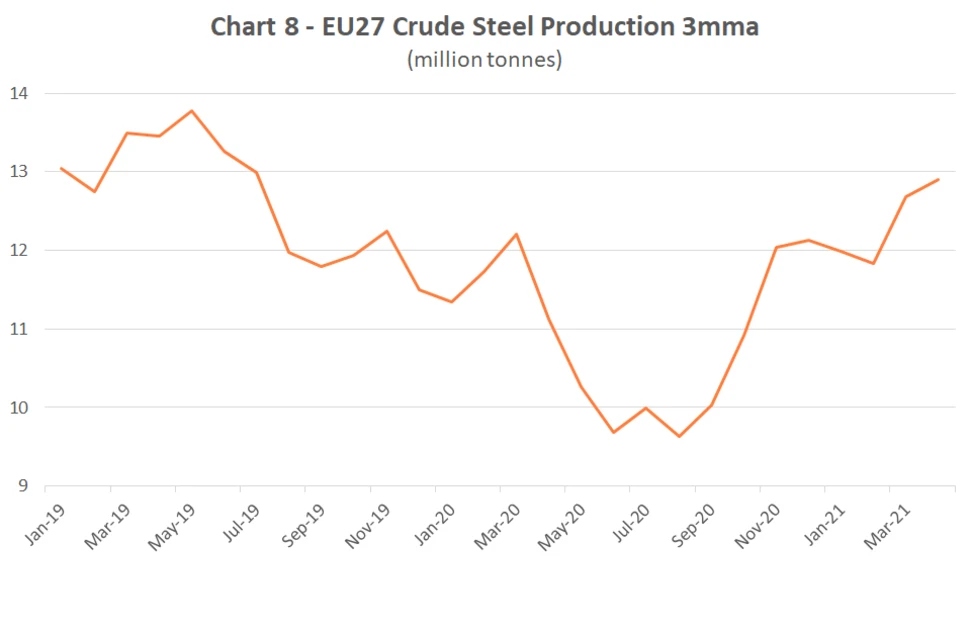

Towards the end of 2020 material shortages started to appear, with the upturn in European steel prices accelerating. Steelmakers focused on long-term contract customers, leaving little material to sell on the spot market. Steel production had increased, but remained at around the relatively low levels witnessed in late 2019 and early 2020 (see Chart 8). Consequently, order backlogs developed at the mills, and distributors reported delivery delays.

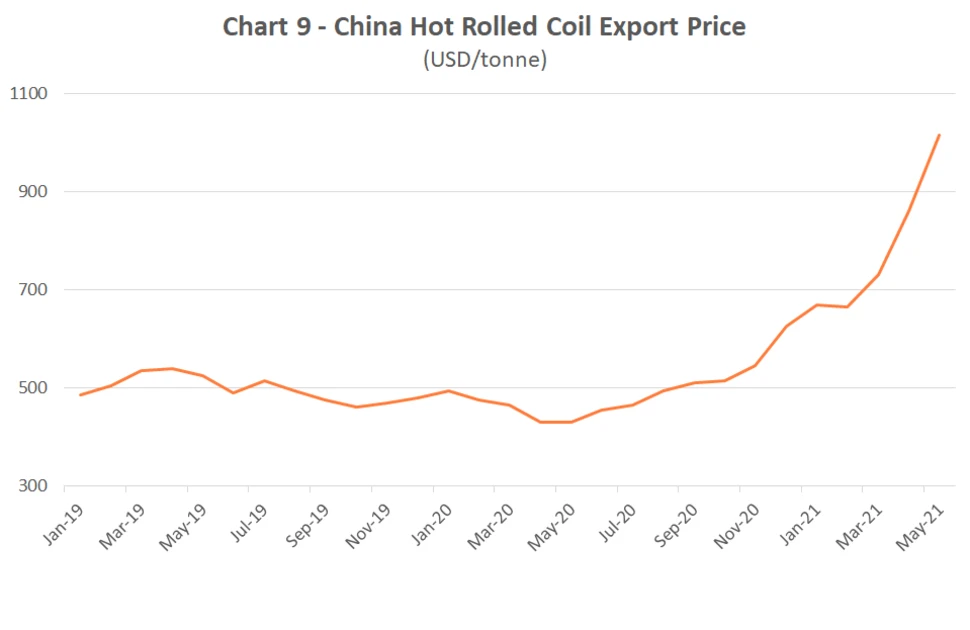

Steel buyers sought imported alternatives, but these proved just as problematic as domestic supply. Soaring global prices, elevated transport costs, port congestion, out of place vessels and trade protection measures created many obstacles to procuring steel from overseas (see Chart 9).

In the spring of 2021, with supply tight from both European and foreign sources, local mill delivery lead times continued to extend. This enabled the steel producers to regularly lift their selling prices, with minimal opportunities for buyers to negotiate, if they wished to secure material.

It should be noted that the pandemic-induced scenario of tight availability and soaring prices is not restricted to the steel sector. Disruption to global supply chains has been witnessed for many non-ferrous metals, commodities and raw materials, such as copper, plastics and timber.