Automotive strikes’ end will settle US steel industry nerves

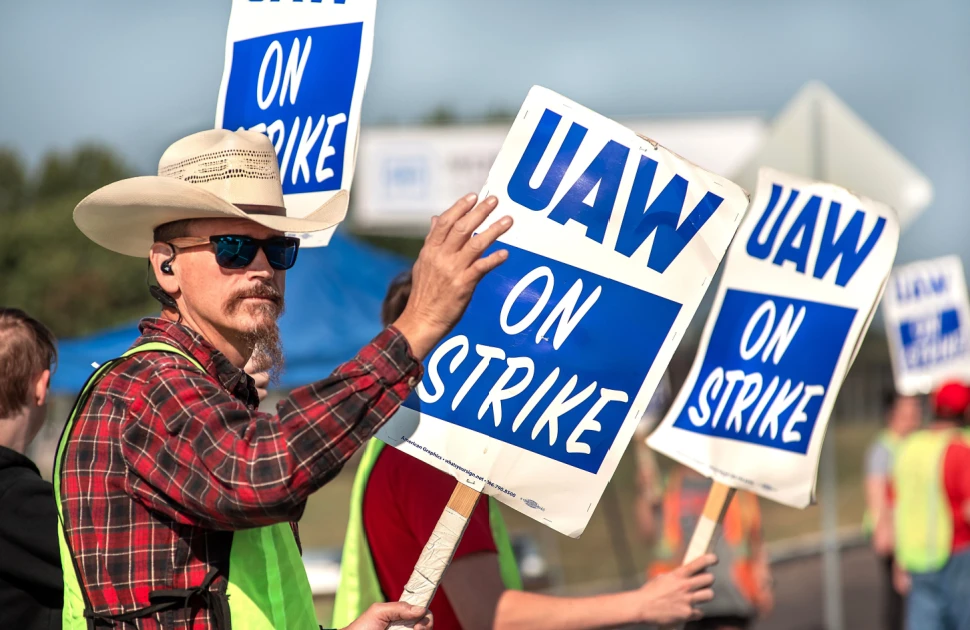

The United States’ automotive supply chain will be hoping for a return to business as usual after workers at the country’s ‘Big Three’ carmakers agreed to new employment contracts. Members of the United Auto Workers (UAW) union have signed an agreement with Ford, GM and Stellantis – ending six weeks of strike action.

Estimates suggest that the action, which involved more than 34,000 workers, cost the US economy USD7 billion. Ford alone reported that it had lost USD1.3bn. The settlements reached by OEMs and the UAW should guarantee some stability for workers and suppliers alike. They include a 25% increase in base wages and terms that run until April 2028.

Importance of automotive

Automotive is a major sector for the United States’ largest steelmakers, accounting for almost a third of revenues. Despite the influence of automotive production losses, MEPS research shows that US steel prices have recovered from a summer low.

Hot rolled coil prices fell to their lowest level this year, reaching USD660 per short ton, as strike action got underway in September. Hot dipped galvanised coil with a G90 coating declined to USD965 per short ton, meanwhile, its lowest level since October 2020.

Steel prices have been rising in the US during recent months, however. Stable demand, relative to that in many other large global economies, and steelmakers’ efforts to reduce capacity have mitigated the effect of the automotive sector’s challenges.

Sector outlook

New car sales in the United States are expected to grow by more than 10% in 2023. The sector experienced a stronger-than-expected first half of the year. Raised interest rates are expected to weaken consumer appetite in the new year, however. Car sales in developing automotive markets across the world should keep the sector in growth, globally, in 2024.

Steelmakers will be closely monitoring the development of emerging markets and OEMs’ push toward sustainable production in the medium term.

China now dominates global vehicle production, producing over 26 million units in 2022, compared with the nine million units produced in the US. In the first half of 2023, China’s BYD sold 1.25 million vehicles. It is now the world's largest manufacturer of plug-in hybrids and electric vehicles.

Carmakers’ steel demands are evolving. Lighter, high strength steels are being sought out by OEMs targeting net zero. Stellantis, meanwhile, told MEPS that it is establishing “closed loop” supply chains to support each of its production locations. Its aim is to reduce the transport of input material by using local supply partners. Stellantis has also set a target of using at least 40% recycled or green material in all newly produced vehicles from 2030.

Union targets Tesla and Asian OEMs

Against this backdrop of an evolving sector, further industrial action in the US automotive sector may produce future headwinds. The UAW’s success in campaigning for workers at Ford, GM and Stellantis has led it to target improved terms of employment for workforces at other OEMs.

Hyundai, Toyota and Honda all announced that they would increase the wages of their US employees in light of the new agreement with Ford, GM and Stellantis. Nonetheless, these brands, and Texas-based Tesla, have now become a new focus for the union. UAW president Shawn Fain described their workers as “UAW members of the future.”

- This content first appeared in the November edition of MEPS International's International Steel Review. The monthly report provides subscribers with steel prices and indices and market commentary from key steel markets across the globe.

Source:

International Steel Review

The MEPS International Steel Review is an essential monthly publication, offering professional analysis and insight into carbon steel prices around the world.

Go to productRequest a free publication