The rise and fall of European gas prices

How European gas prices surged to unprecedented heights and then plunged by two-thirds – and what it means for steel buyers.

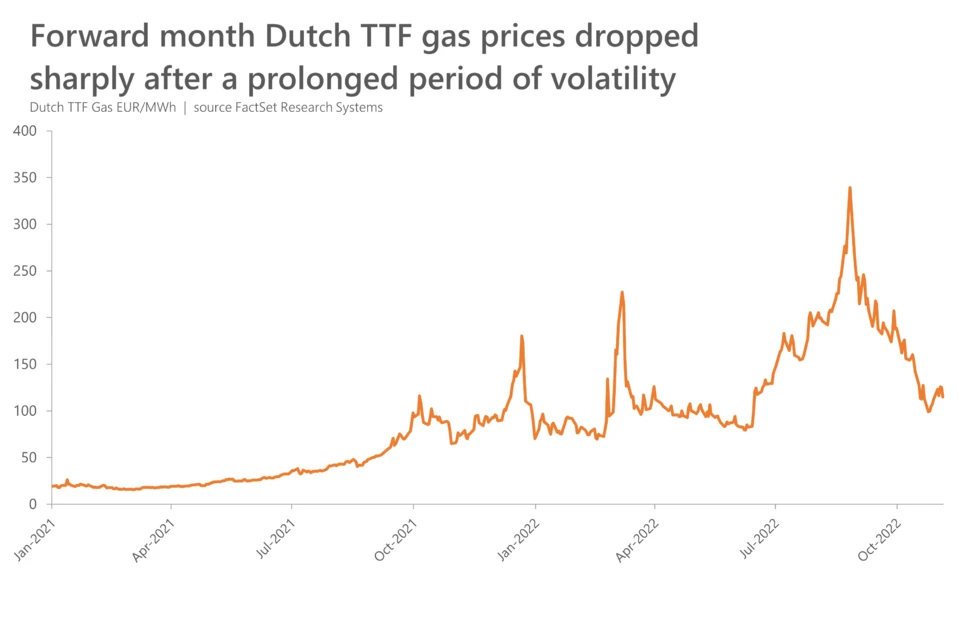

After peaking at 339 EUR/MWh in August 2022, forward month Dutch TTF natural gas futures, a major benchmark for European wholesale gas costs, plunged to just under 100 EUR/MWh at the end of October.

Despite rising again in early November, futures prices remain well below the peak reached in the summer. MEPS envisages continued energy price volatility in the medium term, but such a dramatic fall in gas values has important implications for Europe’s steel buyers.

Why did gas prices rocket?

Before the Covid-19 pandemic, European gas typically traded between 10-25 EUR/MWh. Energy costs were seldom a discussion topic in steel price negotiations.

Gas prices began climbing as countries across the world emerged from virus-related lockdowns in the middle of 2021. Pent-up global demand, particularly in China, fuelled rapid growth in worldwide energy consumption.

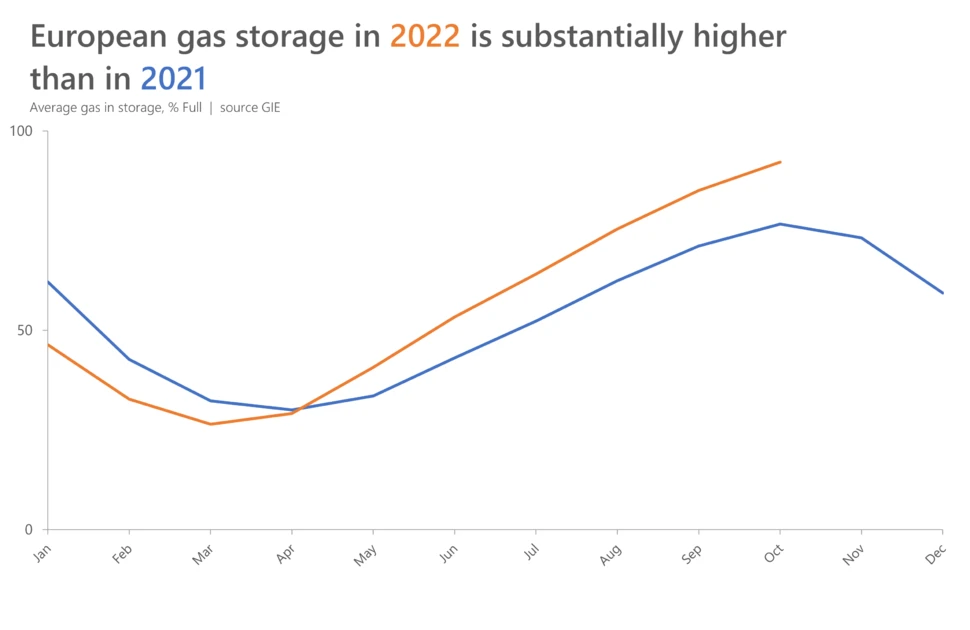

European gas prices spiked twice at the end of 2021. A colder-than-expected winter was met with exceptionally low European gas reserves. Data from Gas Infrastructure Europe (GIE) showed that the average gas storage in October was the lowest it had ever been, for that time of year.

The invasion of Ukraine caused further energy price volatility. As part of the sanctions implemented on Russia by the international community, Germany halted the Nord Stream 2 pipeline project. In retaliation, Gazprom, the Russian majority state-owned gas company, cut the flow of gas through Nord Stream 1.

Europe’s summer heatwave added to the continent’s power woes. Electricity consumption surged in line with greater air conditioning usage, as the public and businesses battled sweltering conditions. Hot weather dried up German rivers, thereby reducing the availability of coal and oil, which are transported by barge. Moreover, a series of leaks, long maintenance periods, and other disruptive events to the Nord Stream 1 pipeline continued to reduce the availability of Russian gas.

Why did gas prices fall so much?

Concerns about shortages led to the European Council placing targets on member states to fill gas storage facilities to at least 80 percent before winter. Those goals were met ahead of schedule. While domestic gas resources typically increase in the months leading up to winter, average reserves in October were around 15 percent higher year-on-year.

Separately, reports are emerging of liquefied natural gas vessels queueing at European ports to offload their cargoes. Backlogs of ships waiting to deliver gas grew this year, as global suppliers of that fuel flocked to Europe to meet the continent’s surging demand.

The weather across Europe, this autumn, is milder than expected. Consequently, the demand for heating is lower than usual, and the continent’s gas inventories are being conserved.

MEPS’ European research partners report that many steel end-users are cutting their production, due to elevated energy costs. The manufacturing PMI figures of the major steel-consuming countries are declining, suggesting that activity in those sectors is deteriorating. Moreover, several domestic steelmakers recently idled melting capacity, because of weak steel demand.

Rhetoric from the European Commission about structural reform of energy markets placed more downward pressure on gas values. The Commission is proposing to introduce a price cap, so long as member states approve the motion.

What does it mean for European steel buyers?

Although costs have fallen, the average gas price remains well above the pre-pandemic figures.

Major European steelmakers tried to lift steel transaction values this summer because of soaring energy costs. In some cases, they specifically cited rising Dutch TTF gas prices as evidence of their increased expenditure. That price benchmark has now fallen considerably.

Furthermore, the average November energy surcharge issued by domestic stainless steel long product manufacturers fell for the first time since July 2022. A major producer of stainless steel plate also announced a large energy surcharge cut for this month.

Determining the exact power costs of mills is complex. The fuel mix used for energy generation by each European country varies widely. Moreover, mill energy expenditure is dependent on several factors, including the specific steelmaking route, raw material quality, plant efficiency, and the type of contracts used to purchase power and fuel. For example, recent energy price increases may not yet be reflected in longer term deals.

Nevertheless, MEPS’ analysis of a typical mill’s input costs shows that falling gas values are contributing to a sharp decline in energy expenditure.

Is energy price volatility the new normal?

The current, lowered gas prices are likely to be temporary. The underlying conditions that caused the reductions, such as high gas storage and warm weather, will dissipate as winter sets in. The rapidly changing dynamics of the war in Ukraine also provide substantial upside risks, despite the move by the European Commission to introduce energy market reforms.

Notwithstanding the prevailing market conditions of low demand, high inventories and limited purchasing activity, European steel distributors are monitoring gas prices closely. Energy costs will continue to play a significant role in steel price negotiations.

Source:

European Steel Review

The MEPS European Steel Review is an informative, concise and easy-to-use monthly publication, offering unique professional insight into European carbon steel prices.

Go to productRequest a free publication