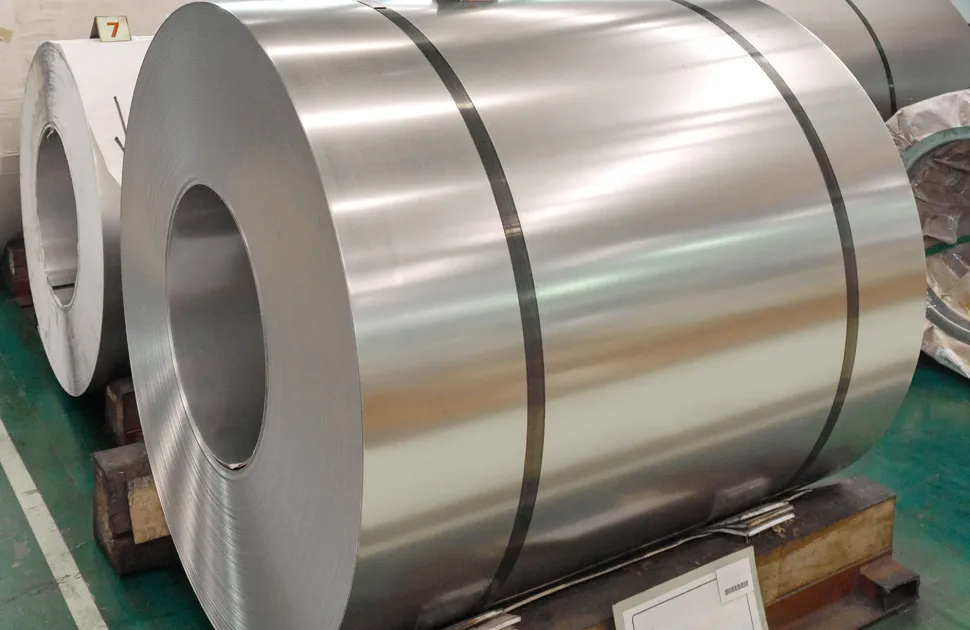

EU stainless steel mills fail to pass on raw material cost increases

European stainless steel prices continued to fall, despite rises in regional mills’ published alloy surcharges, in June. The majority of distributors and stockists now negotiate deals with the stainless steel producers using an ‘effective price’, rather than the traditional ‘basis plus alloy surcharge’ mechanism.

Costs for stainless steel raw material ingredients are expected to rise, moderately, in the medium term. However, in the current market climate, where demand is substantially lower than pre-Covid-19 levels, European stainless steel producers are finding it increasingly difficult to pass on rises in raw material expenditure, without the systematic application of alloy surcharges.

Low demand

European stainless steelmakers continue to operate at reduced volumes of output. Traditionally, a restriction in supply would help mills maintain or even increase selling values. This is not possible, with the current level of demand.

Most distributors and stockists have sufficient inventory of commodity grade stainless steel. Many of them are attempting to sell as much material as possible, to reduce their stock levels.

In addition, some market participants expect that import tonnages will rise, temporarily, following the EC safeguard quota renewal in July. Much of this steel was ordered prior to the coronavirus-related slump in demand. However, reduced purchasing activity, during the lockdown period, is likely to result in lower volumes entering Europe in the coming months.

The low level of activity, in the market, has led to increased competition, for sales, between distributors. Consequently, resale values, for commodity grade stainless steel, have weakened. Margins are tight.

Most supply chain participants rely on a minimum number of large tonnage orders to turn adequate amounts of stock. However, with those enquiries currently absent, many are reliant on their ‘added value’ services, such as polishing, slitting and laser cutting, to increase profits.

Source:

Stainless Steel Review

The MEPS Stainless Steel Review is an invaluable monthly guide to international stainless steel prices and includes the latest global stainless steel industry analysis.

Go to productRequest a free publication