EU reveals plan to double steel tariff and cuts quotas

The European Commission’s replacement for its current steel import safeguard measures will see tariff-free quota volumes cut by 47% and above-quota tariffs raised to 50%, if approved.

Details of the EU’s proposed trade defence measures for steel were unveiled in a press conference hosted by European Commission Executive Vice-President Stéphane Séjourné and Commissioner Maroš Šefčovič yesterday (October 7) afternoon.

The measures are scheduled to come into force July 1, 2026, and remain valid until July 2031, with an interim review scheduled no later July 2027. However, they must first gain approval from the European Parliament and Council of Ministers.

Overview of the new measures

Among the key measures proposed by the new trade defence measures are:

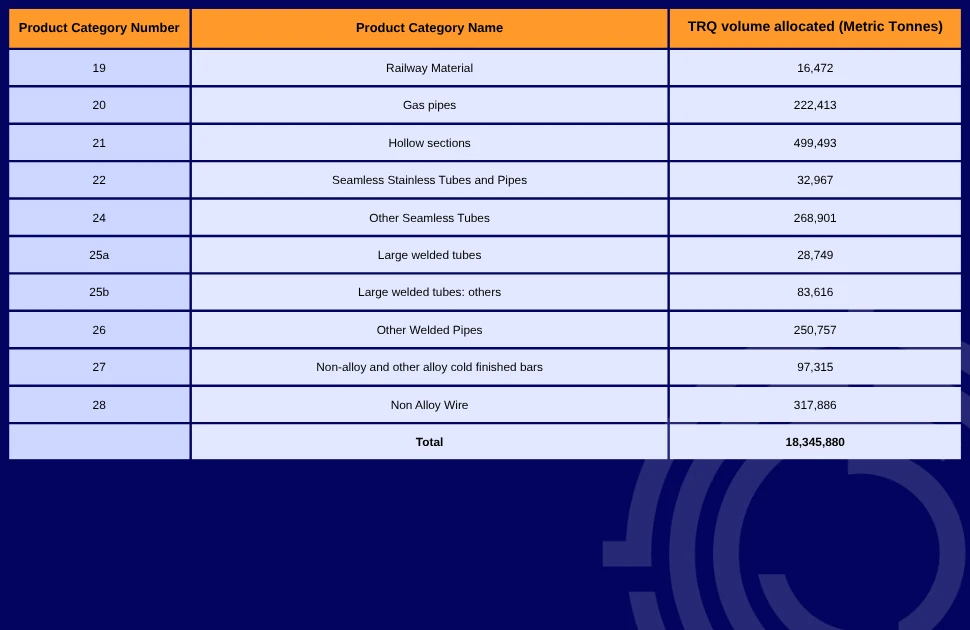

- The reduction of the tariff-free annual steel import quotas, by 47%, from 33 million tonnes to 18m tonnes. This would reduce import market share to 13%.

- An increase in the above-quota tariff rate from 25% to 50%.

- A requirement for importers to disclose the location of “melt and pour” for all third-country material.

- An end to the rollover of unused steel import quotas from one quarter to the next.

- Scope for the European Commission to add to the list of affected products.

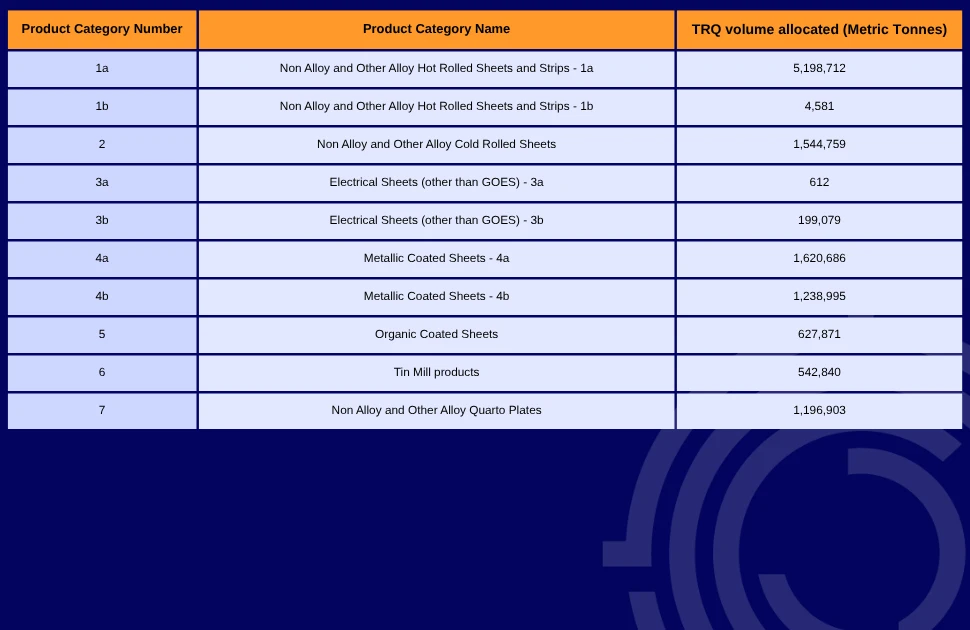

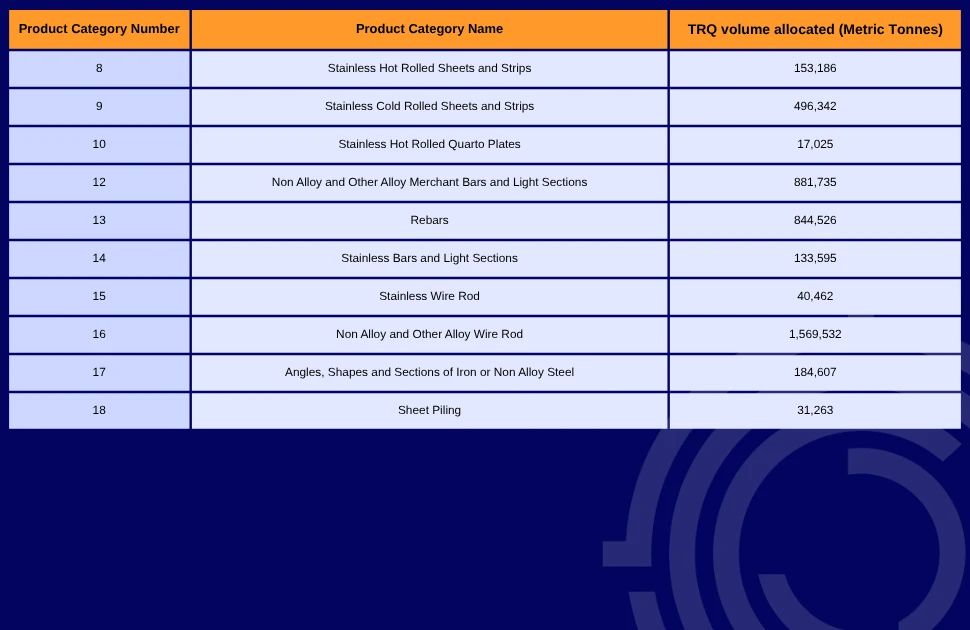

Documentation published by the Commission detailed the proposed tariff-free quota volumes, which are detailed in the MEPS picture carousel, above. The new tariff-rate quota system’s country-specific quota allocations will be confirmed at a later date.

Initial details indicate that all steel product categories covered by the current safeguard measures will face reduced quotas and increased tariffs, while other “steel derivative products” may be added at a later date.

These developments align the EU more closely with the trade defence measures recently implemented in the United States and Canada.

Séjourné said that the tightening of the EU’s trade defence measures for steel was necessary to protect the EU from global steelmaking overcapacity. This is projected to reach 721m tonnes by 2027, five times the EU’s current level of consumption.

He said: “The revised system aims to combat global steel overcapacity and unfair competition.”

Séjourné insisted that the new measures would comply with WTO rules. However, the shift from a temporary safeguard measure to a longer-term trade defence instrument fundamentally changes the EU’s position under international trade law. Because these new tariffs are no longer framed as a safeguard, they open the door for other countries to impose equivalent countermeasures on EU steel exports.

This introduces a significant diplomatic and political hurdle. The Commission must secure consensus among all 27 member states, which have differing exposure to steel imports and exports, before implementation. Even if approved, the EU could face retaliatory tariffs from key trading partners, potentially complicating ongoing negotiations on compensation.

Industry and market reaction

Commenting on the Commission’s trade defence announcement, MEPS steel market analyst Jon Carruthers-Green said: “After months of speculation, the industry finally has some clarity on what will replace the EU’s steel safeguard measures. That said, a great deal of detail, including country-specific quota volumes, has yet to be released.

“The announcement comes at a time of considerable flux for the European steel sector, with the upcoming definitive phase of CBAM set to reshape trade patterns further.

“Some market participants have already suggested that producers will use this development as a springboard for steel price increases in the coming weeks, although securing buyer acceptance may prove difficult given that end-user demand remains stubbornly weak.”

The Commission is expected to publish detailed implementing regulations and quota breakdowns in the coming months, followed by a consultation period for stakeholders.

The European Steel Association (Eurofer) said that the new trade measure is a “major leap forward to save EU steel” going on to recommend that the European Union fast-track the new measures “as a matter of urgency to enable its entry into force at the beginning of 2026”.

Further trade defence developments likely

In recent months, the EU and US have signalled a willingness to collaborate on insulating their respective steel sectors from global overcapacity. Under the terms of their July trade agreement, both sides expressed interest in “ring-fencing” their domestic markets by closer aligning their trade defence measures. This could lead to the creation of a tariff rate quota for steel, aluminium and derivative products which bypasses the current 50% US Section 232 tariff.

Additionally, steel trade association Eurometal has begun lobbying the European Commission to extend the forthcoming trade defence framework to cover “steel derivative products”, much in the same spirit as recent US Section 232 practices. Eurometal argues that many finished goods and components with high steel content currently slip past safeguards and CBAM, distorting competition and undermining Europe’s supply chain.

Source:

European Steel Review

The MEPS European Steel Review is an informative, concise and easy-to-use monthly publication, offering unique professional insight into European carbon steel prices.

Go to productRequest a free publication